|

Identity Theft

Privacy Rights Clearinghouse says that identity theft claims a half a million victims annually and costs financial institutions more than $5 billion. Worse, the crimes themselves are becoming more sophisticated.

Top five states for identity theft:

1. Arizona

2. Nevada

3. California

4. Texas

5. Colorado

For The Customer:

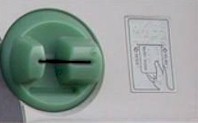

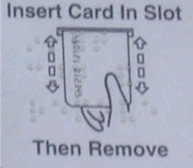

One source of identity theft occurs at the innocent looking ATM. The process is called skimming, here are some tips for customers to help reduce the opportunity that these crooked criminals will skim your ATM card:

1. Be wary of anything about the ATM machine that looks out of the ordinary, such as odd-looking equipment or wire attached to the device.

2. It is also a good idea to always protect your PIN including not giving the number to anyone and to cover the keypad while you are entering your PIN. Do not write your PIN down.

3. Be wary of a “no tampering” (or "please clean your card") sign. These are often placed by crooks to thwart anyone curious about a new piece of equipment.

4. Be wary of a jammed ATM machine that forces customers to use another ATM that has a skimmer attached. Be suspicious of offers to 'help.'

5. Customers should also check their bank accounts regularly to make sure there are no unusual or unauthorized transactions.

6. If you see anything unusual or suspicious around an ATM machine, or if you find unauthorized ATM transactions on your bank account, notify local law enforcement, as well as your financial institution and/or the establishment where the ATM is located.

7 If possible, it is usually best to carry out your ATM transactions during the daylight hours as most ATM-related crimes happen after dark.

A Quick Security Tip: Federal law limits loss from ATM fraud, and many banks offer additional protection. Consumers should check with their financial institution for details.

BANKERS / OWNERS:

1. Make sure that your machines include anti-fraud features to help prevent skimming.

2. Develop alliances with your vendors and other institutions to share information about this type of risk.

3. Encourage your customers to report any non-working ATM, or any machine that appears to be acting strangely.

4. Physically inspect your ATMs on a regular basis. Set up some method for ensuring routine inspections.

5. Examine your ATM activity logs. You should have historical data about usage patterns.

6. Scrutinize all reports of unauthorized account activity to look for commonalities.

7. Notify the Secret Service immediately if a skimmer is discovered. Treat the area as a crime scene. Preserve any security camera footage.

------- Educate your customers. -------

|